The Final Countdown Begins

Taxpayers are running out of time to file their Income Tax Returns (ITR) for the Assessment Year 2025–26, which covers the financial year 2024–25. With September 15, 2025, fast approaching, millions are hurrying to complete their filings.

The countdown has begun for taxpayers. The last date to file Income Tax Return for AY 2025–26 (FY 2024–25) is September 15, 2025, and as the day gets closer, people across the country are rushing to wrap up their paperwork.

What Happens If You Miss the Deadline?

Filing late isn’t just about paying a small fine. The consequences can be bigger than most people expect.

Late Fee Under Section 234F

The Income Tax Department imposes a penalty for late filing. If your income is above ₹5 lakh, the fine is ₹5,000. If it’s below ₹5 lakh, the fine is capped at ₹1,000.

Those with income below the taxable threshold don’t face a late fee, but if you fall under mandatory filing rules (like foreign income, high-value transactions, or TDS already deducted), skipping Income Tax Return is still risky.

Interest on Pending Tax

If you haven’t cleared your tax dues, the problem multiplies. Under Section 234A, you’ll have to pay 1% interest per month (or even for part of a month) on the pending amount.

For example, if you owed ₹40,000 in taxes and filed your Income Tax Return two months late, you’d be charged ₹800 extra in interest—on top of the late fee.

Losing Tax Benefits

Another lesser-known penalty is losing the right to carry forward losses. Say you made a capital loss from stock trading or your business ran into losses this year. If you don’t file on time, you won’t be able to set off those losses against future profits. That’s a benefit gone forever.

Refunds Get Stuck

Even those waiting for refunds have reason to worry. Refunds for timely filers are usually processed quickly, sometimes within weeks. A missed deadline doesn’t just attract penalties—it can also leave you waiting months for your refund.

Prosecution in Rare Cases

In extreme cases where taxpayers willfully avoid filing, the law provides for prosecution. Jail terms can range from three months to two years. Of course, this applies to serious cases involving fraud, black money, or very high incomes—not to ordinary taxpayers.

Can You File After September 15?

Yes, the option exists. You can still file a belated return until 31 December 2025. But belated returns come with strings attached: late fees, interest charges, and the inability to carry forward losses.

The Income Tax Department has also announced that it will start keeping a closer check on people who file their taxes late all the time. This means that taxpayers who regularly ask for extensions may have to deal with more scrutiny in the coming years.

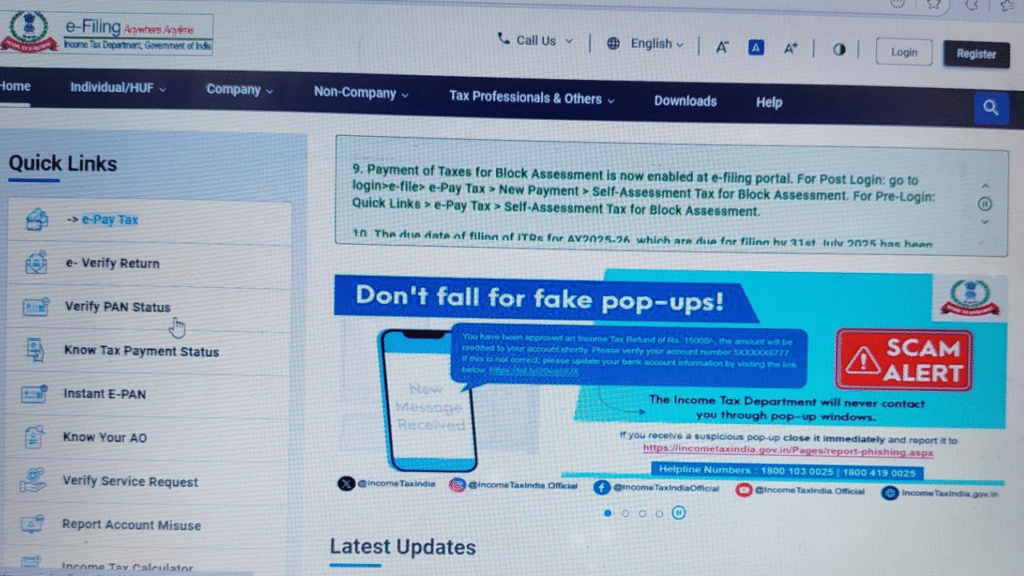

Why People Want an Extension on Their Taxes

People are getting noisier about wanting another extension. Taxpayers and chartered accountants say that there are problems with the IT system, refunds take too long, and they are afraid of making mistakes when they file. A lot of people say that having extra time would help avoid mistakes and cut down on the last-minute hurry.

It’s worth remembering that the original deadline was 31 July 2025. Back in May, the government extended it to 15 September because the updated ITR forms were released late and the system needed more time to stabilize. Now, with the new deadline just around the corner, hopes for another extension are high.

Will the Government Extend the Deadline?

That’s the million-rupee question. As of now, the Central Board of Direct Taxes (CBDT) hasn’t announced any fresh relief.

Government officials point out that over 5 crore ITRs have already been filed, which shows compliance is on track. Unless there’s a major technical glitch in the coming days, chances of another extension appear slim.

Tax experts are advising people not to take chances. Waiting until the last minute—or worse, banking on an extension that may never come—could mean penalties and unnecessary stress. Also read/Apple Launches iPhone 17 Lineup and Ultra- Thin iPhone Air: a Big Lep for 2025

What Experts Are Saying

Chartered Accountants: Extensions create bad habits. People wait until the last week to file, and then the system can’t handle the load.

Tax Consultants: Even if the government gives you additional time, it takes longer to get your money back if you file late, and you’re more likely to make mistakes.

According to financial experts, filing ahead of time is always safer. Taxpayers who postpone filing until the deadline often miss deductions, slip up on details, or deal with slower payment processing. Also Read/ Supreme Court Slams Toll Tax System : Daily Commuters May Finally Get Relief.

Live Updates on Income Tax Filing 2025

9 Sept 2025: Income Tax Department reports that more than 5 crore ITRs have been filed.

10 Sept 2025: Chartered accountants renew demand for another deadline extension.

11 Sept 2025: CBDT silent on any new relief. Experts say don’t wait.

15 Sept 2025: Final deadline for AY 2025-26.

Key Things to Remember

Last date: 15 September 2025

Belated return deadline: 31 December 2025

Penalty: ₹5,000 (income above ₹5 lakh), ₹1,000 (income below ₹5 lakh)

Risks: Loss of tax benefits, delayed refunds, interest on dues, and stricter monitoring in future

Why It Is Important to File on Time

For most people, submitting on time isn’t so much about avoiding fines as it is about having peace of mind. Filing your ITR on time means getting your money back faster, being able to get loans, having your visa processed more quickly, and not having to worry about notices.

As the deadline gets closer, taxpayers should stop worrying about getting another extension and instead focus on finishing their filing on time and correctly. It’s the simplest way to avoid unnecessary penalties—and keep the taxman off your back.